We all want to live debt-free, right? But here's the thing: there's no one-size-fits-all approach to financial freedom. Each of us has our own unique journey, and the choices we make along the way, plus some circumstances outside our control, can either sail us smoothly or get us caught in a debt-filled whirlpool.

That's where the debt snowball and debt avalanche methods come into play. It's like being an adventurer, navigating treacherous terrains or conquering mighty mountains. In your personal finance journey, you can choose one of these strategies to guide you.

Consider this article your trusty financial compass, here to help you understand, compare, and pick the method that suits your unique financial landscape the best.

Understanding debt: key terms and concepts

Before we dive deep, let's decode some financial jargon, shall we?

- Minimum payments: These are the amounts you're required to pay each month to keep your lender happy.

- Credit score: It's like your financial report card, determining how creditworthy you are and whether lenders will give you the green light.

- Credit card debt, student loans, personal loans, and car loans: These are just a few examples of the different types of debt you might owe. We've all been there!

- Interest rate: This is the percentage of interest that your lender will charge for the loan, which can end up costing you the most over time. Yeah, it's a sneaky one.

- Credit card balance: This is the amount you owe on your trusty plastic companion.

- Lenders: These are the folks or institutions who lend you money and set their own interest rates. They hold the keys to the financial kingdom.

Knowing these terms is the first step to steering your financial ship away from the rocky shores of debt.

What is the debt snowball method?

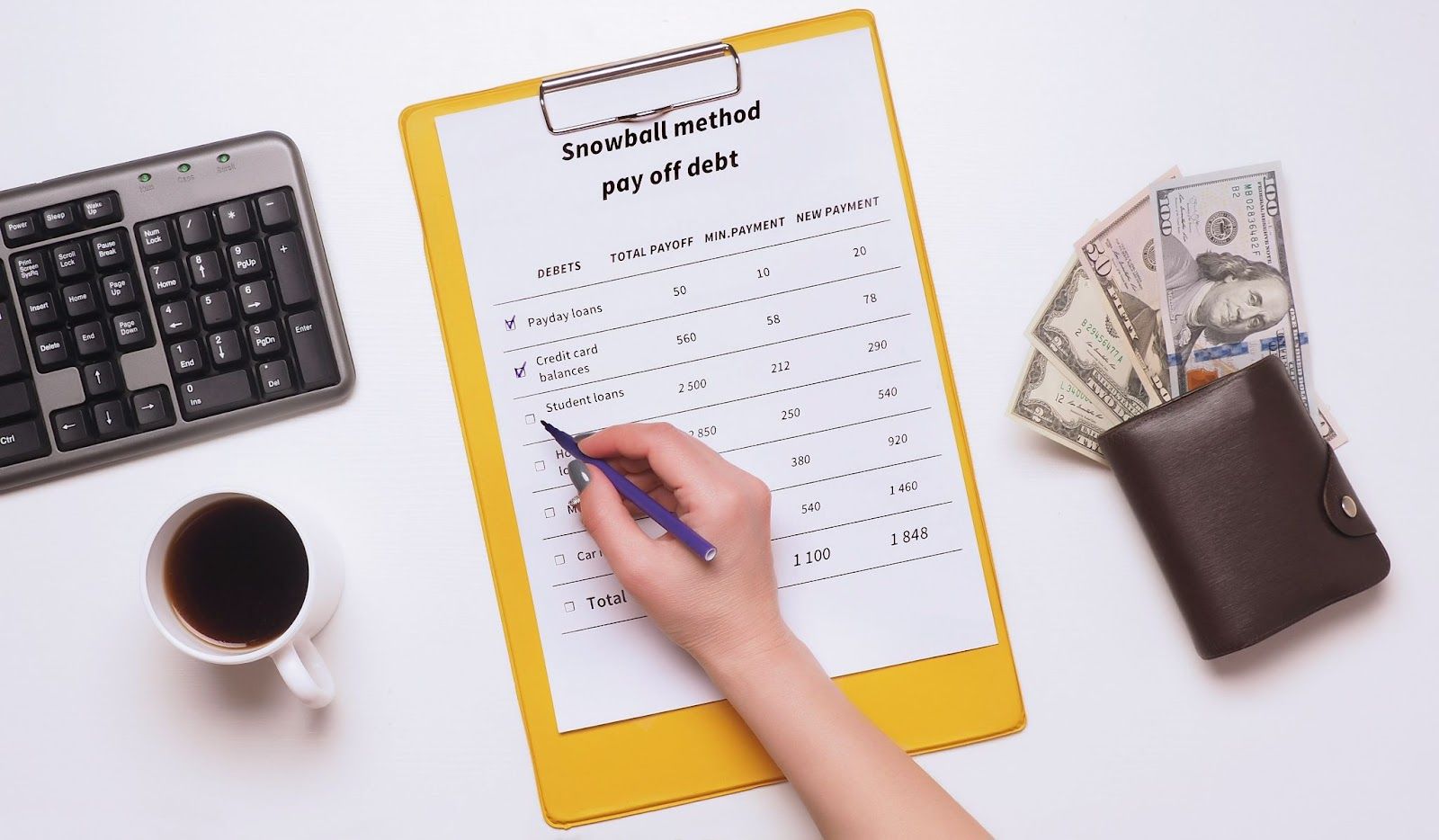

Picture this: a little snowball rolling down a hill, gathering more snow and getting bigger with each turn — that's the debt snowball method in action. With this strategy, you tackle your debts starting from the smallest balance and work your way up, no matter the interest rate.

Here's the deal: You keep making those minimum monthly payments on all your debts, but any extra money you have goes toward paying off the smallest debt first. Let's say you've got a $500 credit card balance, a $2,000 student loan, and an $8,000 car loan. Your focus is on saying goodbye to that credit card debt first.

Why is the debt snowball method so compelling? Well, it's all about those small victories. By paying off the smallest debt first, you see progress right away, and that can be seriously motivating. It's like conquering that first peak on your financial journey — it gives you the push to keep going!

But here's the thing: if you've got a bigger debt with a high interest rate, the debt snowball method might not be the most cost-effective option. You could end up paying more interest over time.

In other words, while the debt snowball method gives you that warm fuzzy feeling of accomplishment and keeps you motivated, it might not be the best choice for your wallet. However, if you thrive on a sense of progress and love celebrating those small wins, this method could be just what you need for your debt repayment strategy.

Remember, your financial journey is uniquely yours to shape. Now, let's explore another route for those who want to tackle high-interest debt head-on.

What is the debt avalanche method?

Imagine an unstoppable avalanche crashing down a mountain — that's the debt avalanche method. This approach takes a more cost-conscious stance on debt repayment. Instead of focusing on the smallest debt, you prioritize debts with the highest interest rates. While the debt snowball emphasizes quick wins, the avalanche method focuses on long-term savings by minimizing the amount of interest you pay over time.

With the avalanche method, you continue making minimum payments on all your debts. But any extra cash you have goes toward the debt with the highest interest rate. Let's say you've got a credit card balance with a crazy-high interest rate, a student loan with a moderate rate, and a car loan with a lower rate. In this case, your extra money would be channeled toward reducing that credit card debt first.

One major advantage of this method is that you can save a ton of money in interest payments over time. By tackling the highest-interest debt first, you pay off your debts faster, avoiding the extra interest that would've piled up.

But here's the kicker: the debt avalanche method requires some serious discipline and patience. However, if you're in it for the long haul and you're all about making smart moves with your finances, the avalanche can be a powerful tool in your debt repayment plan.

Is debt snowball or debt avalanche better?

Now for the big question: Which method is better — debt snowball or debt avalanche?

There's no one-size-fits-all answer. It all depends on your personal financial goals, mindset, and circumstances. Both methods have their pros and cons, but what matters most is finding the approach that speaks to your financial personality.

If you're the kind of person who needs help with motivation, loves celebrating small wins, and gets a kick out of making progress, then the debt snowball method might be your jam. It's all about that sense of accomplishment, and if you need small wins to commit to paying off your debts, it could mean you'll be debt-free sooner than with the avalanche method. (Though you might end up paying more in interest.)

On the other hand, if you're a numbers person who's all about saving the most money in the long run, the debt avalanche method might be more your cup of tea. It tackles those high-interest debts head-on, potentially saving you a boatload of cash in interest payments over time.

Remember, the best debt repayment strategy is the one that you can stick with. Choose the method that aligns with your temperament and financial situation. And hey, it's always a good idea to seek financial advice to make the most informed decision. Becoming debt-free is a marathon, not a sprint, so choose a pace and path that'll get you across that finish line.

Read on for some additional tools and strategies that can complement these methods and supercharge your journey to financial freedom.

Additional debt repayment strategies

While the debt snowball and debt avalanche methods are fantastic strategies, there are a few more tricks up our sleeves that can help you speed up your debt repayment process. Check out these additional tools and see how they can complement your chosen method.

First up is the debt consolidation loan. This strategy involves bundling all your outstanding debts into a single debt. If you're juggling various types of debt, like credit card balances, student loans, auto loans, and medical bills, this tool can simplify your repayment process. Plus, a debt consolidation loan often comes with a lower interest rate, which means less overall interest paid.

Next, we've got the balance transfer option. This one's especially handy for high-interest credit card debt. You can transfer your balance to a credit card with a lower interest rate, making it easier to pay off your debt. Just be sure to read the fine print and understand the terms, as some balance transfer cards have promotional low-interest rates that eventually jump up.

Oh, and let's not forget about building an emergency fund. Unexpected expenses can throw a wrench in your debt repayment plan, so having an emergency fund as a safety net allows you to stay on track without piling up more debt.

Remember, the key is to choose strategies that work for your financial situation and personal goals. And keep an eye on your credit report to gain insights into your financial health and progress toward your debt-free dream.

Wrapping things up

Being in debt can feel overwhelming, but here's the good news: you've got effective strategies at your disposal. Whether you choose the debt snowball or debt avalanche method or a combination of both with some extra tools thrown in, what matters most is having a debt repayment plan that aligns with your lifestyle and financial goals.

These methods aren't one-size-fits-all solutions, and it's crucial to understand how they fit your unique circumstances. Seeking advice from a financial advisor can provide you with tailored guidance and help you navigate the path to debt-free living.

Remember, saying goodbye to debt is just one part of the larger financial puzzle. Consider your other goals, like building an emergency fund, investing for the future, or saving for that dream purchase. It's all about finding balance and making decisions that move you closer to your ultimate financial goals.

So, go ahead and take that first step. Choose your method, and start your journey toward financial freedom today. You've got this!

For more resources like this, explore the Vital Card blog here.

Sources

Debt Snowball Strategy: How Does It Work? | Experian

Find out your financial well-being | Consumer Finance Resources

The Debt Avalanche Method: How It Works and When to Use It | Experian

Debt-Free Living: How to Get Out of Debt and Stay Out | Experian

Vital Card blog posts are intended for informational purposes only and should not be considered financial or any other type of advice.